Tuesday, February 28, 2006

10:40 am - FKLI March is crossing down.

IF FKLI March cannot break 927, it is going to cross down. However, it is still far from 922 (below 50MA) to go short.

10:11 am - FKLI Feb contract is closing today.

Cash gap up and it is not a good sign at the high of 931 and above.

FKLI reacts by gap down. If cash holds on, FKLI wud pick up by lunch.

FKLI reacts by gap down. If cash holds on, FKLI wud pick up by lunch.

Monday, February 27, 2006

10:56 am - FKLI rollover is still on with limited volume

There may be some opportunity in the this week for long position. Look for setup and buy signal.

Thursday, February 23, 2006

4:20 pm - March FKLI has cross up similar to Feb FKLI

There were no cross down for March FKLI and March FKLI cross up again to push up to 922.5.

Stay out for the time being.

Stay out for the time being.

Wednesday, February 22, 2006

4:17 pm - FKLI MACD to cross up

This is not a buy signal as this is part of the earlier cross up which occurred yesterday.

2:22 pm - Trade #2 was stopped out at 923.0

Tighten my stop to 923.0. Loss -2 pts.

This is record loss for 6 consecutive losses. But average losses per trade is 2 pts.

I am waiting for the next winning.

This is record loss for 6 consecutive losses. But average losses per trade is 2 pts.

I am waiting for the next winning.

Tuesday, February 21, 2006

11:19 am - FKLI long setup is forming

Ready for MACD to cross up and long at 924.5/924.0 for Feb Mth or 920.5/921.0 for March Mth.

March Mth wud be better if we can carry the contract longer than Feb Mth.

March Mth wud be better if we can carry the contract longer than Feb Mth.

Monday, February 20, 2006

10:44 am - FKLI is holding on its support 924/924.5

It did break below 923.0 and shot back to 924.0

By ready to go long. The long setup is in the making.

By ready to go long. The long setup is in the making.

Friday, February 17, 2006

12:49 pm - FKLI sell down to 924

I think FKLi is going to selldown lower. However, there is not short setup or sell signal.

Opt to sit this one out.

Opt to sit this one out.

10:14 am - FKLI is becoming unpredictable

Thursday, February 16, 2006

Wednesday, February 15, 2006

4:42 pm - Trade #1 is short at 926.5

MACD cross down and hit below 50MA. Short position is initiated.

Stop loss is at 929.5

Stop loss is at 929.5

4:14 pm - FKLI MACD had crossed down

Need to wait for it to crack below 50MA for short. Else sit out until the wash is completed before going long again.

Tuesday, February 14, 2006

4:35 pm - FKLI long setup is here and buy signal is here.

Based on many false signals over last week, I waiting for this to break 931.0. i.e. it has to break 931.5.

If this break, it wud be the 3rd time.

If this break, it wud be the 3rd time.

2:41 pm - Trade #19 stopped out at 929.0

Short position was not successfully. Loss of 3.5 pts.

FKLI moving sideway and we wud see of lot of entry setup and stop out.

That's trading.

FKLI moving sideway and we wud see of lot of entry setup and stop out.

That's trading.

9:48 pm - FKLI gap up to 928 and hit 929 high

The stop at 929.5 pts was not triggered and selldown to 925.0

Generally, gap up is good day to short FKLI.

Generally, gap up is good day to short FKLI.

Monday, February 13, 2006

4:18 pm - FKLI is hovering above 50MA.

FKLI MACD is abt to cross down. Set short position to go short at 925.5/925.0

Friday, February 10, 2006

11:04 am - FKLI looks like going on a sideway trend

During mid month, FKLI can do sideway movement a lot.

Thursday, February 09, 2006

10:13 am - FKLI gap up and cannot go down further

FKLI MACD about to cross up. It has to break 926.0 for a long signal.

Trade #18 is position to long at 926.5/927.0

Trade #18 is position to long at 926.5/927.0

Wednesday, February 08, 2006

11:25 am - After wash up to 928, FKLI prepare to selldown

FKLI 50MA is at 921.5 and FKLi is low at 922.0. However, the MACD is the middle.

So there is no setup but a short signal.

Stay out until it cross down and below 50MA.

Yes, this is a good location to short but it is NOT part of MACD setup.

So there is no setup but a short signal.

Stay out until it cross down and below 50MA.

Yes, this is a good location to short but it is NOT part of MACD setup.

10:10 am - FKLi cannot hold to up and run up

As all the short position got out, the FKLI return back to 925/926.0

9:49 am - FKLI just cannot break 923 - 3 times

As FKLI cannot break the support at 923.0 and time passes by, more and more traders are eager to get out of their short position (like myself), they tighten their stops.

Naturally, all the stops were triggered all the way to 928.0.

I was in yesterday at 924.5 and got stopped out at 926/926.5. My short setup is not based on MACD cross down.

Naturally, all the stops were triggered all the way to 928.0.

I was in yesterday at 924.5 and got stopped out at 926/926.5. My short setup is not based on MACD cross down.

Tuesday, February 07, 2006

10:13 am - FKLI continues to sell down

FKLi is having a healthy retracement at this point. But at this point, no short position signal nor setup until 50MA is breached.

10:09 am - Short FKLI after 6 days of uptrend

Yesterday, I shorted trade #17 at 930 just after lunch at 2.33 pm when MACD abt to cross down with a stop at 931.5.

There was a wash up to 933.0 before the 4 pm selldown. Stopped out at 931.5

Small loss of 1.5 pts.

There was a wash up to 933.0 before the 4 pm selldown. Stopped out at 931.5

Small loss of 1.5 pts.

Monday, February 06, 2006

10:21 am - FKLI hits high at 931.5 and wud not go higher

At this junction, my stop of 2.0 ATR is at 927.0

Trade #16 is stopped out at 927.0 pt. Profit of 27 pts.

A record win for this year.

Trade #16 is stopped out at 927.0 pt. Profit of 27 pts.

A record win for this year.

Friday, February 03, 2006

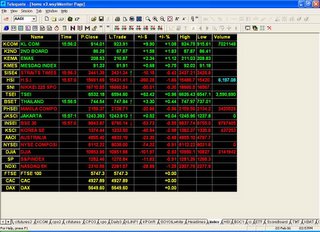

3:57 pm - KLCI cash market buckles against regional markets

Cash market is going against regional markets. This is due to KLCI is out of sync with the world since CNY. However, klci trend wud follow regional

FKLI has been up for 5 days. So, start to think of going short. However, wait for sell setup and short signal.

FKLI last reach high of 931.5 in Sept 2005. If it touches it, it wud the 2nd time it fail to break the 931/931.5 resistance.

Trail stop to 925.0.

Subscribe to:

Posts (Atom)